About NJP

Transition Planning

Certified Financial Transitionst | Strategic Business Planning | Retirees & Pre Retirees

Individuals and Families | 4 Stages of Transition | The Benefits to You

Certified Financial Transitionist®

What is a Certified Financial Transitionist®? What benefits do you get when working with a Certified Financial Transitionist®?

Every person – every client – has or will experience one of the following major life transitions and the likelihood that more than one at a time will be experienced increases with age:

|

|

Traditional financial planning encompasses the important technical topics such as taxes, investments, cash flow and estate planning. But, traditionally trained CFP®’s have not been trained in the human experience of life’s transitions. I have been working and studying both the traditional and the human side for more than 30 years. If I have learned anything, it is that the personal side is not only just as important as the technical side, but it is the side that drives decision making.

Financial Transitionists® understand human transitions on their deepest levels. We know what influences the way we think when our world has suddenly and irrevocably changed. We are able to identify when a transition is going well and have the tools to further enhance the experience. If a client is struggling with their transition, the Financial Transitionist® knows how to keep them safe and help them work through their difficulties.

The CeFT® is a selective, post-CFP® designation, that requires at least five years of direct client contact.

The Certified Financial Transitionist (CeFT®) designation is awarded to those who have completed a 3-part training process. Part 1 is a 1-day Introductory Workshop, which is led by SMI faculty and establishes the foundation of the program, which is anchored in neuroscience, psychology, sociology and adaptive leadership. Part 2 of the process is a 12-month core curriculum training program that delves into the usage of the unique tools and protocols that characterize the work of the Financial Transitionist®. Part 3 is composed of a 1.5 day proctored exam which includes written case essays, structured responses, multiple choice questions and role playing.

In order to maintain the CeFT® designation one must maintain their CFP® designation and meet all continuing education requirements.

Strategic Business Planning

Selling your business and transitioning to the next stage in your life may be one of the hardest things that an entrepreneur will face. We understand the complexities and issues of that change and have a proven process to help prepare for and smooth out that transition.

Retirees and Pre Retirees

Anticipating and ultimately transitioning to retirement can create stress both for the retiree and the family. As an experienced Financial Transitionist® we use our proven process to help you identify and manage your personal expectations as well as those of your spouse/partner and family.

Individuals & Families

Inheritors, widows, couples making big decisions, divorcees, lottery winners, athletes, entertainers…each has a unique set of issues and experiences. We say that change is a gift. Of course, not every life-changing event is experienced that way, particularly at first. But when you realize that even the most heartbreaking or traumatic events are followed by an opening and by opportunity and possibility, you see change as a gift. Financial Transitions Planning is the art and science of helping your clients unwrap that gift and make the most of it.

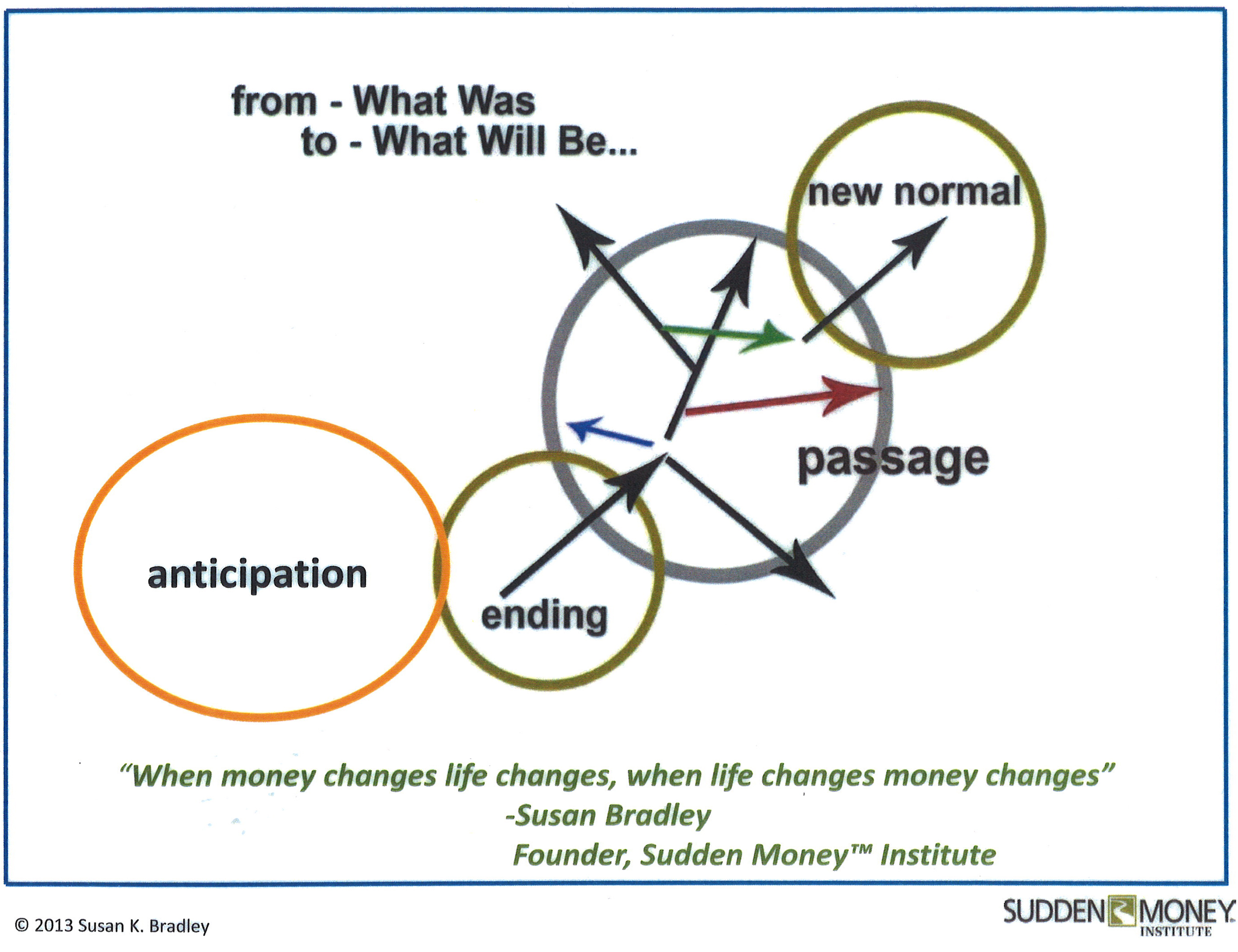

4 Stages of Transition

We have identified the four stages of transition; each with its own elements and pivot points. Our collaborative proven processes allows us to identify the difficulties a client is experiencing (if any) and provide the tools to work through or work with any difficulties in order to minimize the damage they might otherwise do.

The Benefits to You

We help clients to identify their struggles and help them work through them in their own time.

We can’t control all life events, but we can control how we respond to them. The long-term impact of life events, whether they’re planned for or unexpected, celebrated or regretted, will ultimately be formed by the individual’s willingness to sit with the uncertainties and the unknowns, and their patience with moving through their transition in a meaningful way. Change creates the space for transition, which translates into the opportunity for learning, growth, and new meaning.